Comprehensive Wealth

Management

Retirement Income Strategies & Financial

Planning with a Family Focus

Our Story

The Terrio Group is a forward-thinking financial services firm dedicated to helping individuals and families build wealth, protect their future, and achieve lasting financial freedom. Through personalized planning, innovative strategies, and a client-first approach, we empower our clients to make confident decisions at every stage of life.

WE ANSWER TO PEOPLE, NOT PRODUCTS

Financial freedom in retirement doesn’t have to be an unreachable goal. The people we work with often walk

away with renewed confidence in the financial resources and strategies we supply. Not because they didn’t know

how to use them, but because no one’s ever shown them how.

Make the shift from reactive consumer to proactive investor.

TESTIMONIAL

OUR SERVICE

Financial Planning

Our proprietary process is based on

the proven results of our

independent advisors.

Tax Planning

We create tax efficiencies when

building your wealth management

strategy.

Investment Strategies

We custom-tailor investment

strategies geared to enhance your

growth potential.

Annuities & Life Insurance

Leverage annuities & insurance to

safeguard your income.

Ready to Talk?

We can help. We work with you to make your money work for you.

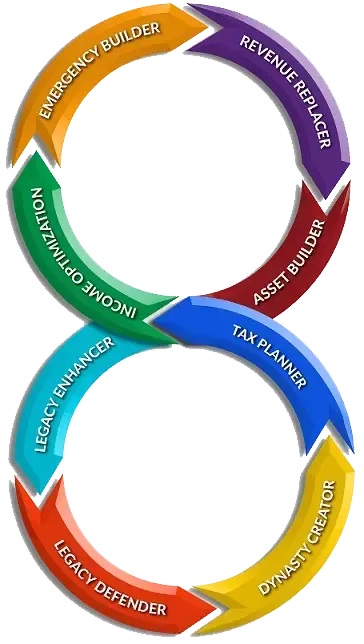

OUR PHILOSOPHY

Financial planning cannot be effective without considering all aspects of your finances as one cohesive, ever-evolving machine. In doing this, we strive to ensure that all the elements are working together to optimize your financial future.

Our signature process incorporates 8 unique elements, including income, emergency funding, asset building, estate protection, legacy

enhancement and protection, and tax planning.